Contribution Margin Per Unit Formula

When only one product is being sold the concept can also be used to estimate the number of units that must be sold so that a business as a whole can break even. What Is the Contribution Margin per Unit Formula.

Contribution Margin Ratio Formula Per Unit Example Calculation

SC - text Total Costs 20 - 11 09 text per Unit S C Total Costs 20 11 09 per Unit.

. Enter a 0 for items with a zero. Contribution Margin Ratio - 17 images - what is contribution margin ratio how to calculate it accounts receivable turnover analysis financial kpis sisense market to book ratio formula calculation example limitations analysis what is the contribution margin 2020 robinhood. Contribution Margin Per Unit Revenue Variable expenses Total Units.

Calculate the total contribution margin. The profit per unit will come to. Divide your costs by the number of units they represent to get the cost per unit.

Total revenue variable costs of units sold. Contribution represents the portion of sales revenue that is not consumed by variable costs and so contributes to the coverage of fixed costs. To determine the ratio.

150 - 85 65. The formula for contribution margin and ratio is as follows. Your company sells 100 cupcakes at 150 each.

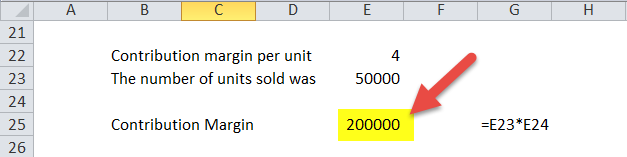

Formula of contribution margin and ratio. Contribution Margin Per Unit Total Contribution Margin Number of Units Sold. The Contribution Margin Formula is.

Contribution Margin Per Unit Formula. Total revenue variable costs of units sold. The formula for contribution margin dollars-per-unit is.

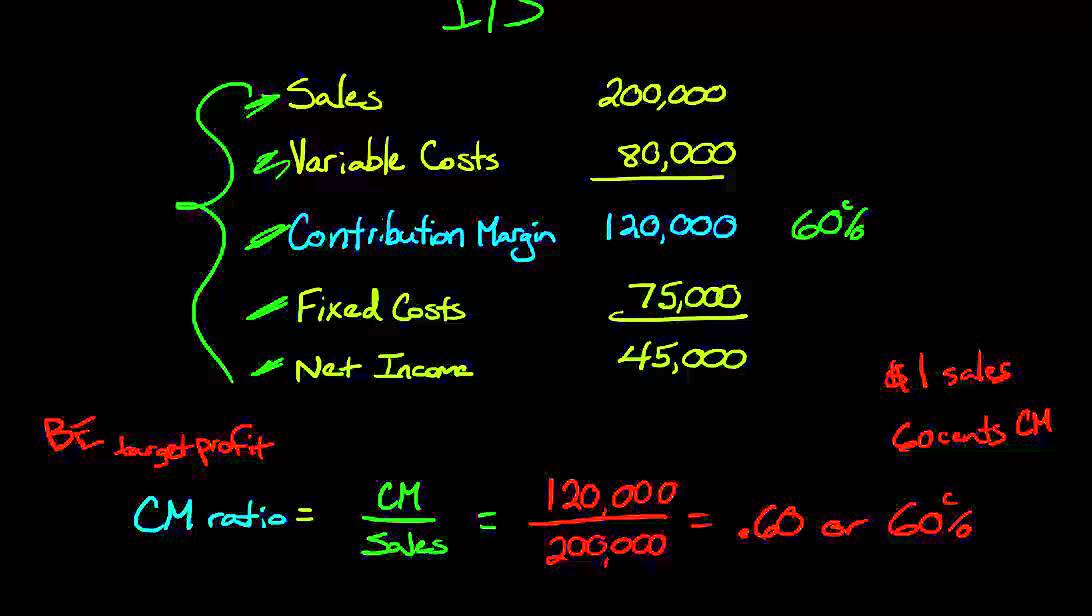

Contribution margin dollars 50M 20M 5M 5M 20 million Contribution margin ratio 20M 50M 40 The fixed costs of 10 million are not included in the formula however it is important to make sure the CM dollars are greater than the fixed costs otherwise the company is not profitable. Contribution Margin Fixed Costs Net Income. What is the contribution margin from the sale of all 100 cupcakes.

Begin by showing the formula and then entering the amounts to calculate the units Madlock must sell to break even. For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping and labor expense of 200000. It cost you 85 to make the 100 cupcakes.

For example a company sells 10000 shoes for total revenue of 500000 with a cost of goods sold of 250000 and a shipping and labor expense of 200000. Sales- Variable Expenses Fixed Expense Contribution Margin Formula. 1620000 10000.

Complete all input fields. Thus the calculation of contribution per unit is. Calculation of Variable Cost Per Unit.

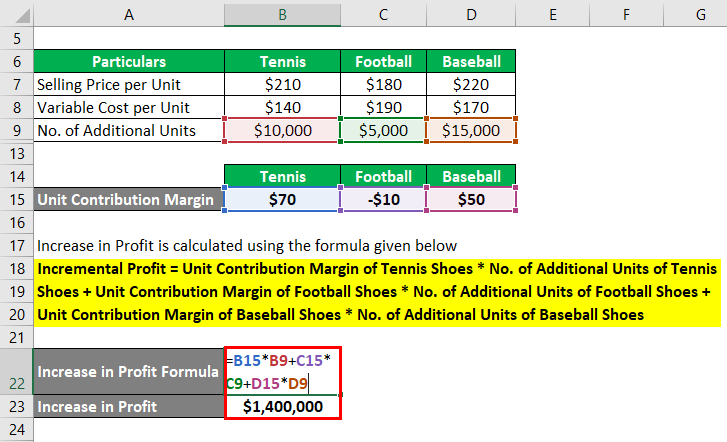

Contribution margin CM or dollar contribution per unit is the selling price per unit minus the variable cost per unit. In terms of computing the amount. MR Contribution margin ratio.

In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost. Output of the company 10000 units. TR Total Revenue.

Fixed costs are 1800 per month. Contribution Margin Net Sales Variable. For example if a business has 10000 of fixed costs and each unit sold generates.

Contribution margin per unit formula. TC Total Cost. The contribution margin formula is calculated by subtracting total variable costs from net sales revenue.

Thus for September 2019 the variable cost per unit of the company comes to 162. Formula for Contribution Margin. Sells a product with a contribution margin of 10 per unit.

Divide this number by your sales to express your profit margin as a percentage of sales. Contribution Margin Per Unit Per Unit Selling Price Per Unit Variable Cost. Contribution Margin Formula.

The formula for contribution margin dollars-per-unit is. Contribution Margin Net Sales Revenue Variable Costs. Contribution Margin Ratio.

Contribution margin ratio formula. MC Break even point in units or dollars BEP The contribution margin ratio is the proportion of each sales dollar that contributes to covering fixed expenses. CM contribution margin.

Essentially doubling the. Next subtract your cost of production per unit from your income per unit for gross profit per unit. Contribution Margin Revenue Variable costs.

Total Variable Expenses 1620000. Solution for Madlock Inc. Accordingly the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price.

Total revenues - Total variable costs Total units Contribution per unit. Contribution Margin Ratio Net Sales Revenue -Variable Costs Sales Revenue Sample Calculation of Contribution Margin.

Contribution Margin Formula And Ratio Calculator Excel Template

Unit Contribution Margin How To Calculate Unit Contribution Margin

Unit Contribution Margin Meaning Formula How To Calculate

Contribution Margin Meaning Formula How To Calculate

Contribution Margin Ratio Youtube

Contribution Margin Ratio Revenue After Variable Costs

0 Response to "Contribution Margin Per Unit Formula"

Post a Comment